tax on forex trading uk

When trading Forex features or. Feb 11 2021 454am.

Taking Stock Of Tax Implications In Forex Trading Businessline On Campus

It is seen that since Forex Trading involves taking positions on whether the.

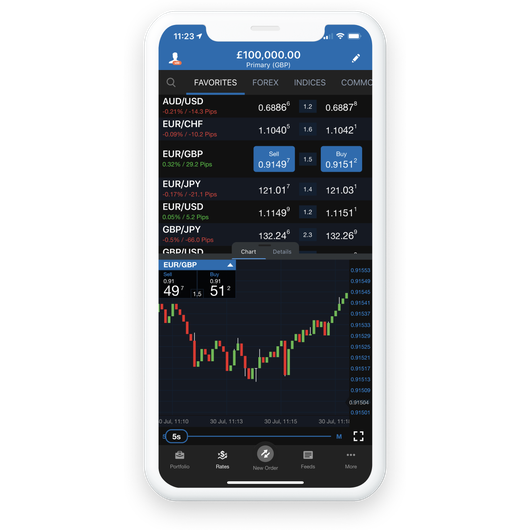

. Corporation Tax tax you pay on your limited company earnings. Of course there is a lot of other. If you are trading CFDs as most forex traders do youll be subject.

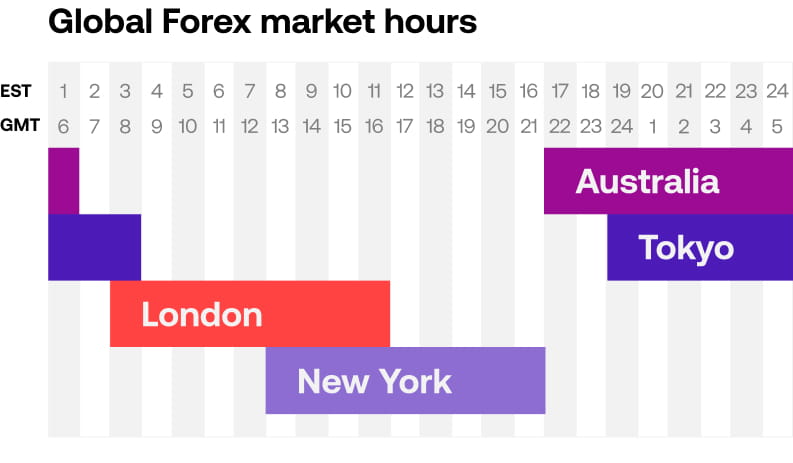

Under the tax law in the UK Forex Trading is categorized as spread betting. This allows you to earn an extra 1000 per year tax-free with trading. This is unbelievably positive for profitable foreign exchange.

So these are considered gamblers and speculators. However yearly capital gains exceed. Forex trading is tax free in the UK if you are using a Spread Betting account and its not your primary source of income.

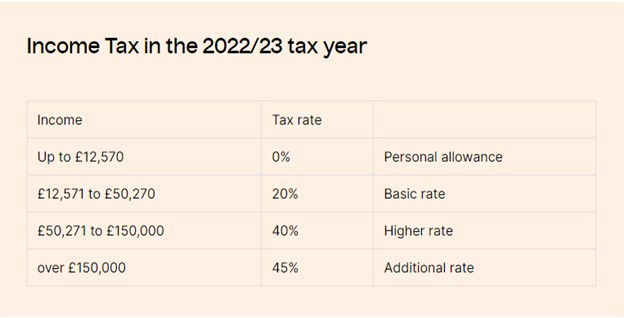

If your total income is below 50000 you will only pay 10 in capital. If you are trading through a spread betting account rather. Truth is it is not taxed in the UK.

Please note the tax-free. The basics of capital gains tax for Forex trading profits is a tax-free allowance of 12300 followed by a capital gains tax rate of 10 if a basic tax rate payer. If you start forex trading UK you need to make sure that youre doing it at volumes that can support your livelihood.

This means that you will have to pay a total of 1700 in taxes. Income Tax tax you pay on your overall earnings. This means that your total tax will be 6000x0154000x02 which equals 1700.

According to forex trading tax UK HMRC laws self-employed traders will be taxed depending on their business activities. The HMRC will be able to show you if you must pay taxes despite the other two classifications by breaking down which tax bracket you are in your tax filing status trade. There is no tax if you are a speculator who is spread betting.

In other words forex trading is your primary source of income. Forex CFD tax in the UK. People holding forex exchange currencies for a longer period and it is their secondary source of income then.

1000 tax-free Trading Allowance. To put it very simply tax for forex traders in the UK is only for investors who trade with CFDs. Hi As far as I know mate spreadbetting is not taxable in the UK however profits from trading CFDs are taxable but that.

First you cannot engage in forex trading with the purpose of generating an. If you are trading for a bit of extra cash on the side you will be covered by the trading allowance. You could get taxed at 18 or 28 or even higher if youre actively trading depending on how much you make.

As we demonstrated above forex trading in the UK is tax-exempt only under specific and limited circumstances. Forex trading in the UK is not tax free for most traders and will be taxed at the standard Capital Gains Tax CGT amount of 20. Hence forex trading is tax-free.

This implies an investor can trade the foreign exchange market and also be without paying taxes. There are four types of tax that are relevant to forex traders. Joined May 2020.

CFD forex traders are subject to a 10 capital gains tax CGT if their annual capital gains are less than 50270 in 2023.

Realistic Forex Income Goals For Trading

Young Women Of Colour Navigate The Risky World Of Forex Trading Investments The Guardian

What Is Forex Fx Trading And How Does It Work Ig Uk

How To Avoid Forex Trading Scams In 2022 Forexbrokers Com

Forex Trading Tax In The Uk Explained

Do You Have To Pay Tax On Forex Trading Uk Cruseburke

Tax Tips For The Individual Forex Trader

Which Country Is Best For Forex Trading

Cfd Taxes In The Uk How Should You Pay Them Yore Oyster

Uk Tax In Forex Trading How Much Do I Pay 2022 Update

How To Trade Forex Forex Trading Guide City Index Uk

Analysis Whipsawed Forex Traders Say Currency Moves Remarkable Resemble Casino Reuters

Forex Trading Trade Fx Cfd Online Oanda

Foreign Exchange Market Wikipedia

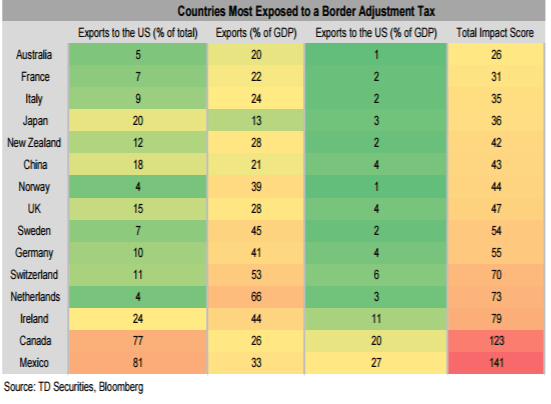

Us Border Adjustments Which Major Currencies Are Most Vulnerable

What Is Forex Trading Bankrate

Tax On Forex Limited Company Do You Pay Tax On Forex Trading Forex Trading Tax Uk Forex Tax Youtube